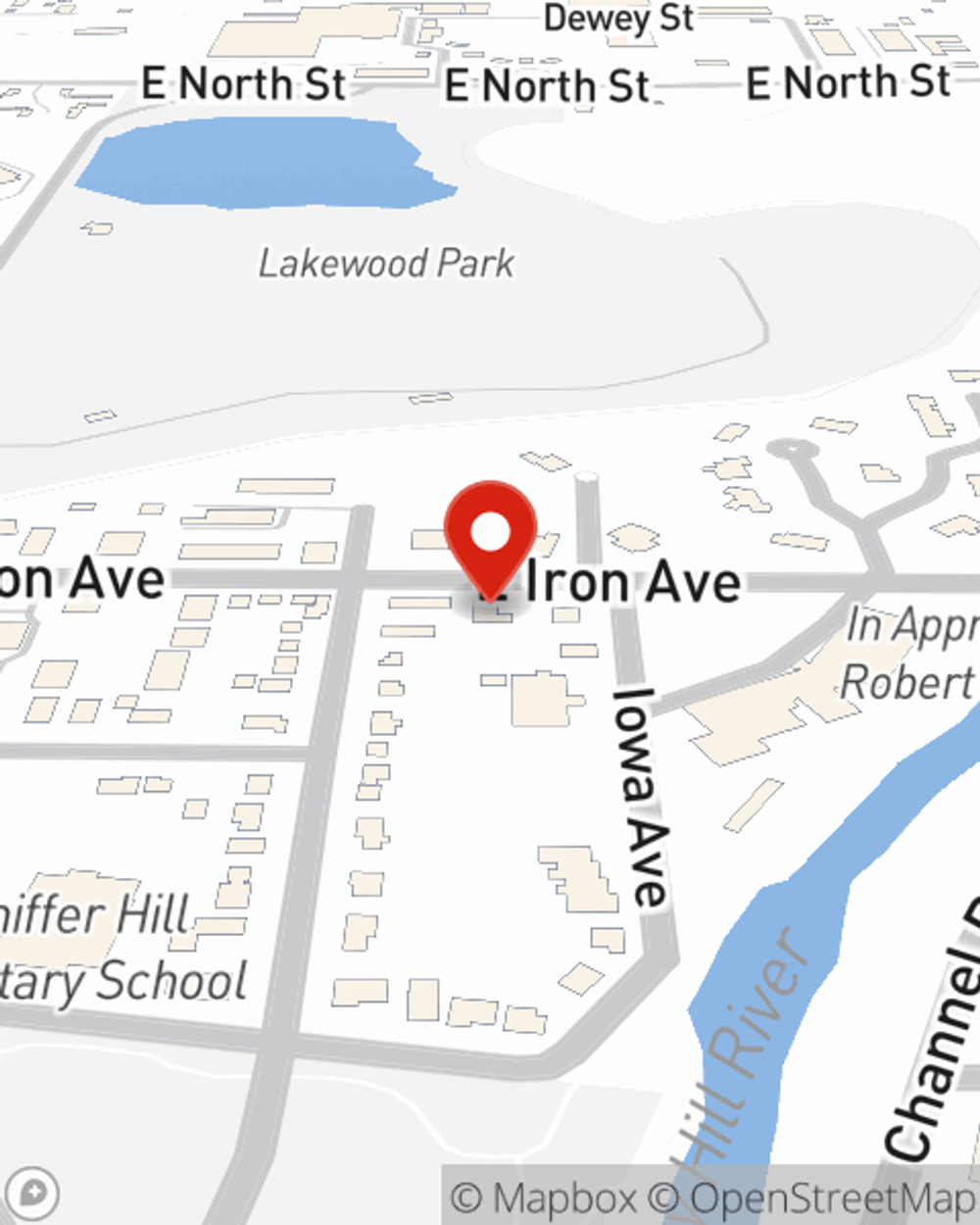

Condo Insurance in and around Salina

Get your Salina condo insured right here!

Insure your condo with State Farm today

- Salina, KS

- Abilene, KS

- Lindsborg, KS

- Assaria, KS

- Gypsum, KS

- Minneapolis, KS

- Solomon, KS

- Saline County, KS

- Dickinson County, KS

- McPherson County, KS

Calling All Condo Unitowners!

Because your condo is your home base, there are some key details to consider - size, neighborhood, cosmetic fixes, and making sure you have the right protection for your home in case of the unexpected. That's where State Farm comes in to offer you outstanding coverage options to help meet your needs.

Get your Salina condo insured right here!

Insure your condo with State Farm today

State Farm Can Insure Your Condominium, Too

Your home is more than just a roof over your head. It's a refuge for you and your loved ones, full of your personal property with both sentimental and monetary value. It’s all the memories you hold dear. Doing what you can to help keep it safe just makes sense! A next great step is getting a Condominium Unitowners policy from State Farm. This protection helps cover a wide range of home-related unexpected events. For example, what if a fallen tree smashes your garage or lightning strikes your unit? Despite the disruption or aggravation from the experience, you'll at least have some comfort knowing your State Farm Condominium Unitowners policy that may help. You can work with Agent Bill Roberts who can help you file a claim to help assist replacing your lost items. Preparing doesn’t stop troubles from landing on your doorstep. Coverage from State Farm can help get your condo back to its sweet spot.

Finding the right protection for your condo is made painless with State Farm. There is no better time than today to contact agent Bill Roberts and explore more about your great options.

Have More Questions About Condo Unitowners Insurance?

Call Bill at (785) 827-1707 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Bill Roberts

State Farm® Insurance AgentSimple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.